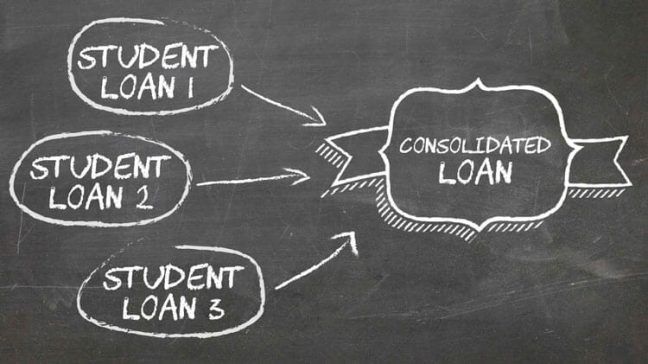

Consolidation

One of the most beneficial option is consolidation. Generally, federal loans can be consolidated; including Stafford and Perkins loans. PLUS loans and Supplemental loans can also be consolidated. Consolidation allows the borrower to easily keep track of payments. There are also options to extend the repayment period. An important fact when it comes to consolidation is that it may extend the term of repayment.

Standard Repayment

The Standard Repayment plan is the most basic plan and most borrowers will be placed in this plan as they enter repayment after grace period. With this plan, the monthly amount stays the same each month during a repayment of up to 10 years. Because of this, the interest amount would be the lowest of all the options available. This option may not be for everyone because it requires reliable income source to meet the monthly payment expectations. There is also a minimum $50 per month payment requirement.

Graduated Repayment

The Graduated Repayment program is designed to help borrowers who have low income now, but expect to see their earnings rise over time. Borrowers will see their monthly student loan payment increase every 2 years if they choose to take advantage of this repayment plan. While this may be a good option for some, note that the interest continues to accumulate on the unpaid portion of the loan balance for a longer period of time.

Extended Repayment

The Extended Repayment option allows the borrower more time to repay the loan – 25 years. While the monthly payment amount is decreased, the number of payments is increased. This option is available for borrowers who have at least $30,000 in federal loans, combined. This is a good option if the borrower does not quality for other payment plans, but borrowers should know that while they will be paying less each month, over the life of the repayment, they will pay more in interest.

HOW LONG WILL IT TAKE YOU TO REACH ZERO?

financialservice.com free credit card payoff calculator shows you how long it will take to pay off credit card debt using minimum payments and how much it will cost.

Pay as You Earn

Pay as You Earn caps maximum monthly payment at 10 percent of household discretionary income, as long as that payment is less than what one would pay under the Standard Repayment Plan. Financial hardship will be determined based on income and family size. If loans are repaid for 20 years under this program, then any remaining balance will be forgiven. Note that the forgiven amount is taxable. New Direct Loan borrowers, as of October 1, 2007, with a disbursement made after October 1, 2011 may qualify for the Pay as You Earn Repayment Plan.

Income-Based Repayment

The Income-Based Repayment (IBR) plan sets payments at a percentage of household discretionary income. For new borrowers on or after July 1, 2014, IBR caps payments at 10% of household discretionary income. These borrowers will also receive forgiveness after 20 years of repayment. For borrowers who were issued their first loans before July 1, 2014, IBR limits payments to 15% of household discretionary income. These borrowers will be eligible for loan forgiveness after 25 years of repayment. Note that the forgiven amount is taxable

Income-Contingent Repayment

The Income-Contingent Repayment (ICR) does not have a financial hardship requirement, which makes it easier to qualify. The repayment period is 25 years, and anything left after that is forgiven. Note that the forgiven amount is taxable. The monthly payment amount is calculated as the lesser of 20% of discretionary income OR what the payment would be on a fixed, 12-year payment plan, adjusted according to income. Based on individual income, payments could be higher. The interest rate for this plan is fixed for the life of the loan.

Income-Sensitive Repayment

The Income-Sensitive Repayment (ISR) is an alternative to Income-Contingent Repayment (ICR). The monthly loan payment is pegged to a fixed percentage of gross monthly income — between 4% and 25%. The percentage is determined by the borrower and the resulting monthly payment must be greater than or equal to the interest that accrues. Some lenders set a minimum threshold on the percentage of income based on the individual’s debt-to-income ratio. Borrowers must reapply for income-sensitive repayment each year. They are usually required to provide a copy of their income tax returns and/or W-2 statements every time they apply for Income-Sensitive Repayment (ISR). Because Income-Sensitive Repayment decreases the monthly payment, as compared with Standard Repayment and is limited to a 10-year repayment term, it increases the size of the rest of the monthly payments to compensate. This will also increase the total amount of interest paid over the lifetime of the loan.

Household discretionary income is calculated by finding the difference between the adjusted gross income and 150 percent of the annual poverty line based on family size and state. This means that each student loan payment is individualized to match the borrower’s specific income, costs of living, and family size under the IBR plans.

BSTAR FINANCIAL SERVICES: We understand the predicament of most people struggling to pay their Debt. We recognize an information gap, a difficulty where to get help and get a right answer on repayment plans, loan discharge or forgiveness. We are not a Lender. We are not a Collections Company. We are not a Debt Relief Company. We work for You, the Borrower. We assess your Debt alongside your financial situation. We educate you so you can make the right decision. We can speak for you to relieve your stress from collectors. And, spare you from the complications and time consuming paperwork. Upon your direction, we will take care of preparing your applications and along with your supporting documents for submission to the right authority.